Our Business Advisory Statements

Our Business Advisory Statements

Blog Article

The Basic Principles Of Business Advisory

Table of ContentsBusiness Advisory Fundamentals ExplainedWhat Does Business Advisory Do?6 Easy Facts About Business Advisory ExplainedIndicators on Business Advisory You Should KnowHow Business Advisory can Save You Time, Stress, and Money.

Recurring Training and Assistance: Bookkeeping franchise business often offer continuous training programs to maintain their partners upgraded on the most up to date conformity laws. This guarantees that businesses are always in advance of changes without needing to spend greatly in independent research or staff training. In Australia, navigating tax obligations, work regulations, and numerous state laws can be discouraging.With the assistance of accounting franchise business, navigating this facility landscape ends up being much less complicated. These franchise business, such as Accounts All Sorted, supply the competence and tools needed to ensure businesses remain certified with their commitments. By utilizing the sophisticated systems and expert guidance provided by accounting franchise business, local business can focus on what they do bestexpanding their procedures.

Whether it's with automation or customised advisory solutions, the benefits of choosing a reputable bookkeeping franchise business can not be stressed enough. Partnering with a relied on franchise empowers organizations to prosper in a competitive market while fully abiding by Australian guidelines. Local business conformity refers to the adherence to regulations, laws, and requirements that govern organization procedures in Australia.

Business Advisory Can Be Fun For Everyone

High-grade provides you tailored solutions to make far better service decisions. At Prosperity Associates, we aid organizations expand by making the most of relevant economic chances and utilising self-displined methods. For more details on and what we can do for you, get in touch today. Starting an organization is an interesting time, full of opportunity and potential.

Among the most vital things to obtain right during this critical period is capital monitoring. Even the tiniest blunder can delay development and placed the service at threat. This is where comes in. A goodwill help you continue top of your cash flow, making certain that you take advantage of every buck.

Treasury offers policy recommendations to sustain Australian little services. business advisory. We're dedicated to making sure fairer and quicker repayment times for tiny organizations.

Small organizations can likewise access free workshops, webinar discussions and self-directed tutorials. The NewAccess for Small Business Owners program gives complimentary and confidential phone-based psychological health mentoring to assist tiny service proprietors handle the pressures linked with running a company.

The Business Advisory Diaries

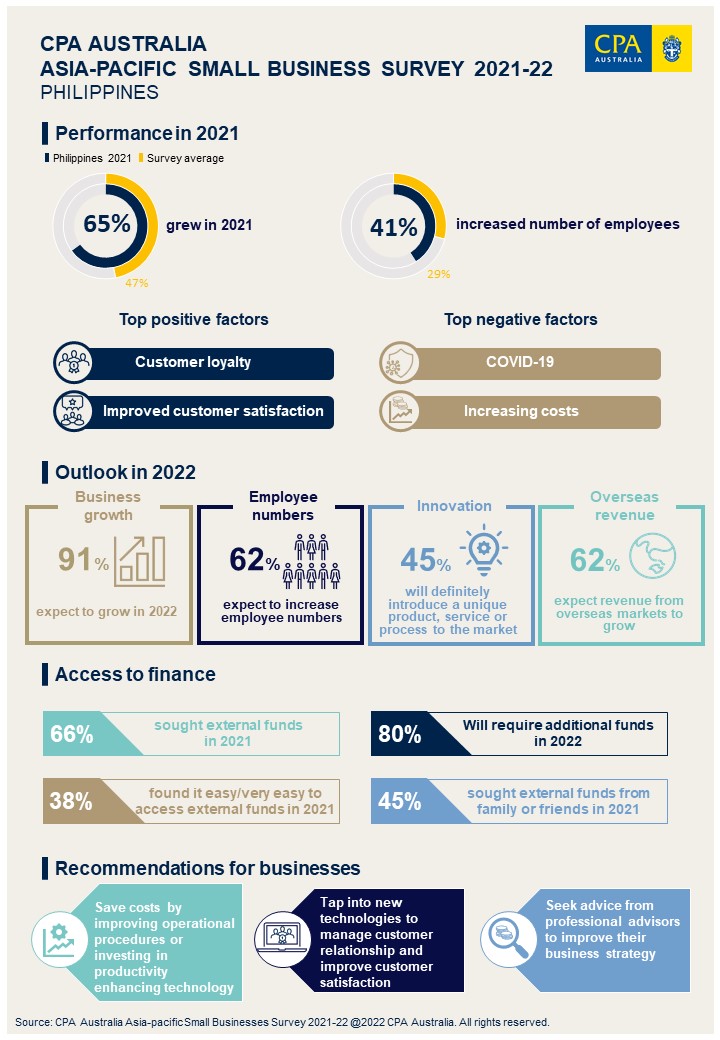

This post was existing at the time of publication. As small companies emerged from the hard years of the pandemic, it was reasonable to assume that the only way was up. While findings from Certified public accountant Australia's 15th yearly Asia-Pacific small service study program that 2023 was a year of development for the majority of small companies in the region, those in Australia experienced a weaker one year than anticipated.

/Business%20Advisory%20Services%202.jpg?width=400&height=800&name=Business%20Advisory%20Services%202.jpg)

Gavan Ord, Elder Supervisor - Company and Financial Investment Policy at certified public accountant Australia, says ballooning expenses proved a major obstacle for Australian small services in 2023. Fifty per cent of Australian respondents pointed out increasing expenses as having a significant negative effect on their organization. This compares to the survey standard click over here of 40 percent.

Technology continues to be a competitive advantage for the best carrying out little services throughout the Asia-Pacific. The study shows those in Australia are much less most likely to use the most recent modern technology than their regional equivalents.

Little Known Facts About Business Advisory.

"Putting approximate targets for reducing expenditures, such as by five or ten per cent, can result in an under-investment in growth locations and missed out on possibilities to make modifications in under-performing locations." Ord notes that this is just one area where advisors can aid their small company clients to do well. He includes that the survey can additionally be utilized as a tool to motivate clients to boost their operations.

"Federal government can offer even more information and assistance around technology fostering. This consists of information around what modern technology might be best for their service," he says.

"We assume the best method to get to even more small companies is by collaborating with their consultants, whether that be their accountants or IT experts. These advisers already have actually a relied on relationship with the little service and recognize their demands. "At the micro level, small companies are exceptionally time inadequate and source poor," says Ord.

Technology proceeds to be an affordable advantage for the best performing small organizations throughout the Asia-Pacific. The study reveals those in Australia are much less likely to use the latest modern technology than their local counterparts.

Business Advisory for Beginners

"Putting approximate targets for cutting expenditures, such as by five or 10 per cent, can bring about an under-investment in growth locations and missed opportunities to make adjustments in under-performing areas." Ord keeps in mind that this is simply one area where consultants can help their small company customers to be successful. He includes that the survey can likewise be made use of as a tool to motivate clients to enhance their procedures.

"Federal government can offer more details and assistance around technology adoption. This consists of details around what innovation could be best for their useful source business," he says.

"We believe the finest means to get to even more local business is by dealing with their advisors, whether that be their accounting professionals or IT professionals. These advisers already have a relied on connection with the small company and comprehend their requirements. "At the micro level, little services are exceptionally time inadequate and source inadequate," claims Ord.

Report this page